Kuala Lumpur, May 9, 2025 | EPF Withdrawal — A new policy has once again stirred nationwide attention! With the official rollout of the EPF 2025 policy, Malaysia’s Employees Provident Fund (KWSP) is undergoing unprecedented transformation. Many are now asking: “Can I still withdraw funds? Is the new KWSP withdrawal process more complicated? Will this affect my retirement savings?”

These questions are not just about immediate finances—they deeply impact our retirement planning and long-term security. In this exclusive report, we dissect the latest changes in EPF withdrawals, decode the new KWSP withdrawal process, and reveal the truth behind a crucial but often overlooked question: “Are you withdrawing wisely, or risking your future?”

EPF Withdrawal | Not Just Taking Money—It’s a Strategic Life Decision

In the past, people believed EPF withdrawals were only for retirement. However, EPF has gradually evolved into a multi-purpose withdrawal platform, covering housing, education, medical expenses, and even business ventures. While this flexibility offers convenience, it also challenges Malaysians’ financial planning.

According to official EPF data, over 40% of withdrawals are done without a complete retirement plan, and more than 60% of those aged 60 and above face serious fund shortages. Hence, the EPF 2025 policy strongly emphasizes “rational, not reckless” withdrawals.

Put simply, withdrawing isn’t wrong—but withdrawing without a plan is.

[Updated Info] KWSP Withdrawal Process Now Smarter, Faster & Safer

As of 2025, the KWSP platform has adopted a fully digital and AI-enhanced system, making the withdrawal process more streamlined and transparent than ever:

- Log in via the MyEPF portal or KWSP mobile app

- Select your withdrawal category (e.g., housing, healthcare, education)

- System automatically generates eligible withdrawal amount based on your age, balance, and reason

- Upload supporting documents

- Await e-approval (average processing time: 3 working days)

- Approved funds are directly credited into your bank account

This upgraded KWSP withdrawal process reduces manual intervention and leverages smart algorithms to ensure better decision-making and fraud prevention.

3 Key Highlights of the EPF 2025 Policy You Shouldn’t Miss

To ensure members balance withdrawals and future security, the EPF 2025 policy introduces three core reforms:

1. Phased Withdrawal System

Members can now set “scheduled withdrawals,” avoiding lump-sum depletion and encouraging better fund distribution.

2. Withdrawal Impact Calculator

A new digital tool simulates how different withdrawal choices affect your long-term savings—ideal for smarter retirement planning.

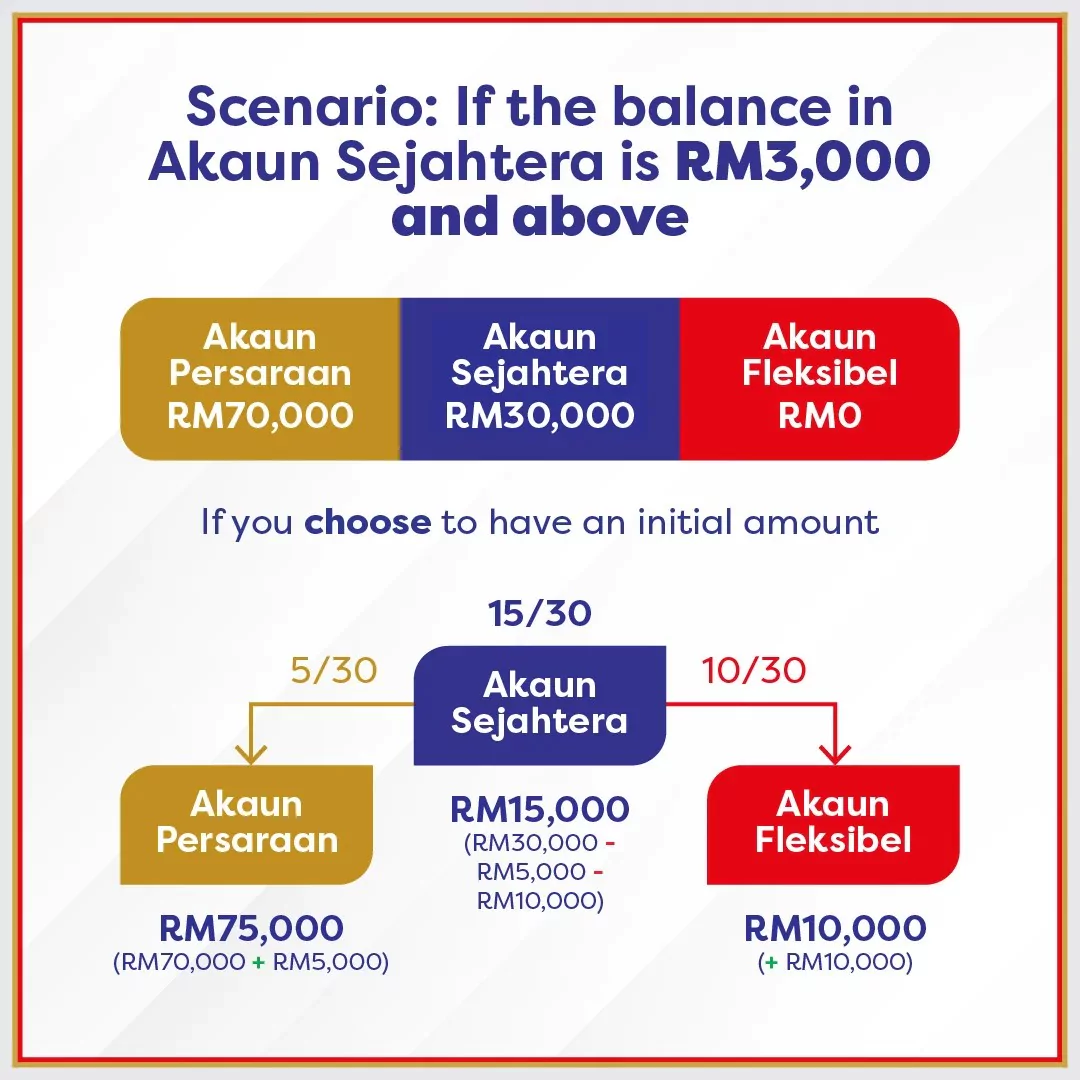

3. Account 3 Pilot Program (High Flexibility Account)

This trial account allows members to channel a portion of monthly contributions into a semi-liquid fund for emergencies—while keeping the core savings untouched.

3-Step Retirement Planning: Withdrawal ≠ Freedom, It’s Just the Beginning

Withdrawing funds is easy. Planning for retirement is not. If you only focus on the short-term cash, you may overlook the long-term consequences. Here’s our 3-step approach to make your withdrawal strategy smarter:

- Before Withdrawing: Ask yourself, “Why do I need this money?” Are there better alternatives?

- During Withdrawal: Use the EPF simulator to evaluate impact on future retirement funds

- After Withdrawal: Explore backup savings options like PRS (Private Retirement Scheme) or self-directed investment plans

Remember: Every ringgit you withdraw today is one less ringgit for your tomorrow.

Expert Warning: Is EPF Withdrawal Becoming a Misused Financial Tool?

Malaysian financial expert Mr. Lim remarked, “Too many people treat EPF like an ATM and forget its true purpose: retirement.” He emphasized that failure to adapt to the EPF 2025 policy and its new flexibility features could result in complete depletion of savings before age 40.

This is especially concerning as the latest policy reinforces a “self-accountability” framework, shifting more responsibility to the member. So, understanding the KWSP withdrawal process is just the beginning—wise planning is the real key.

Final Word: Withdraw Smart, Not Fast—Because Retirement Is Forever

The flexibility and convenience of EPF withdrawal are commendable, but they come with serious responsibility. Only when we truly understand the KWSP withdrawal process, align with the EPF 2025 policy, and approach our retirement planning proactively, can we confidently say:

“I withdrew today, but I planned for tomorrow.”

Let every Malaysian walk a path of wisdom—where withdrawal meets strategy, and retirement meets peace of mind.