SmartWills Malaysia target customer: In Malaysia, the way people handle inheritance and estate planning has changed in the past decade. More individuals are turning to digital will-writing platforms, seeking convenience, security, and a way to manage their assets without the complexities of traditional methods. Among the many platforms emerging in this space, SmartWills Malaysia has carved a niche. But who exactly are their customers? And what drives them toward a fully online legacy planning service?

1. Digital natives prioritizing convenience

The most visible group among SmartWills Malaysia’s target customers are Malaysians in their late 20s to early 40s. These individuals grew up with technology, trust online platforms for financial transactions, and often have young families or growing careers.

For them, digital will writing platforms align with their lifestyles: minimal paperwork, quick access, and the flexibility to update documents as life circumstances change. Many see it as a natural extension of online banking or e-insurance.

2. SmartWills Malaysia target customer: Young families focusing on security

Another significant segment comprises young parents who have recently purchased homes, cars, or investment plans. With dependents relying on them, they want to ensure that if something unexpected happens, their loved ones are financially protected.

Family inheritance planning through digital tools offers a sense of security — without the high costs and time commitments of traditional legal consultations.

3. Professionals and entrepreneurs safeguarding assets

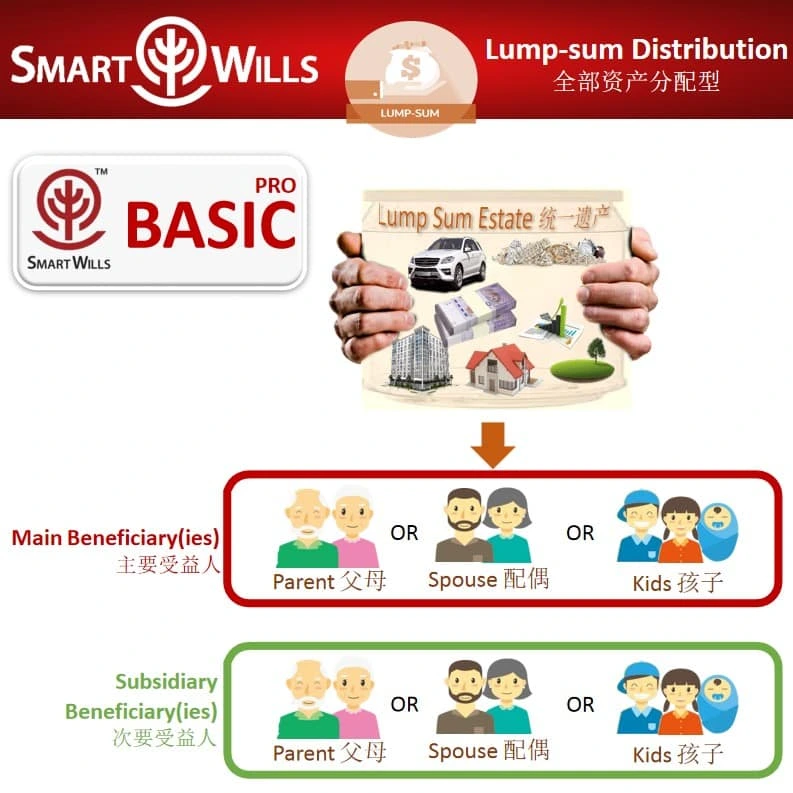

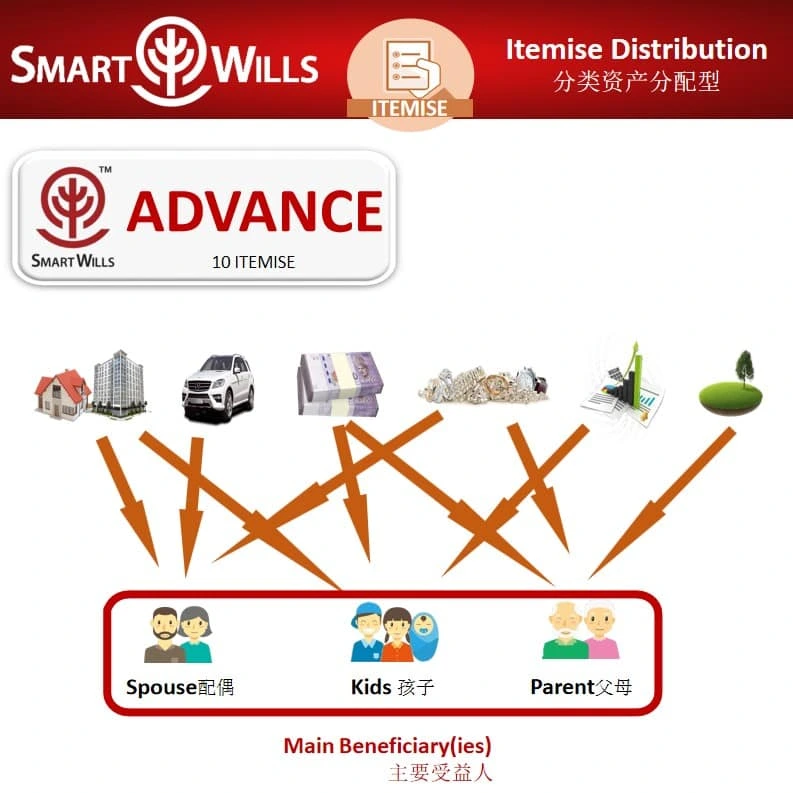

Business owners and self-employed professionals face unique challenges. Their income sources may be diverse, including properties, equity stakes, or intellectual property. SmartWills’ digital system allows them to structure wills that reflect complex holdings, ensuring legacy planning in Malaysia keeps pace with their evolving portfolios.

This group values the ability to manage updates remotely — essential when assets or ventures span different states or even countries.

4. Retirees embracing tech-assisted legacy planning

While retirees were once hesitant about online services, that trend is shifting. Many are now comfortable using digital tools to keep their affairs organized. For them, the appeal lies in clear, user-friendly interfaces and transparent processes.

Some appreciate having a “living document” they can revisit without multiple law office visits, especially if they want to revise allocations among children or grandchildren.

5. SmartWills Malaysia target customer: Why Malaysians are moving to digital wills

Underlying all of these groups is a common driver: the desire for control and simplicity. Writing a will is no longer seen as something reserved for the elderly or wealthy. Instead, it’s becoming a practical step in financial planning, akin to buying insurance.

Platforms like SmartWills Malaysia demonstrate that the importance of a will extends across age, profession, and wealth categories.

6. The social and cultural shift behind the trend

Traditionally, conversations about inheritance have been avoided in many Malaysian households. Yet, with urbanization, rising property ownership, and more complex family structures, the need for clear succession plans has grown.

A digital will writing platform provides privacy and autonomy — allowing users to make decisions on their terms before discussing them with family members.

7. What makes SmartWills Malaysia stand out?

While SmartWills isn’t the only company in the field, it’s notable for making will writing accessible and understandable.

Users often highlight its straightforward process and the reassurance that their wishes will be legally valid. For a generation balancing work, family, and long-term planning, such ease of use can make a difference.

8. SmartWills Malaysia target customer: Is it right for everyone?

Not necessarily. Some estates with highly complex assets or disputes still require traditional, in-person legal consultation. However, for a growing majority, digital platforms for family inheritance planning are a comfortable fit.

The decision often comes down to personal preference, tech literacy, and the perceived importance of keeping documents up to date.

Conclusion: A broadening demographic

From young professionals securing their families’ futures to retirees updating long-held plans, SmartWills Malaysia’s target customers are diverse. What unites them is a shift in how Malaysians think about inheritance: planning ahead, reducing burdens on loved ones, and embracing tools that fit a digital-first lifestyle.

Offical Website:SmartWills Malaysia

Email:enquiry@smartwills.com.my

Contact: 012 664 4929 (Sales) / 012 334 9929 (Customer Service)

Address:No. 46A (1st Floor, Jalan Ambong 1, Kepong Baru, 52100 Kuala Lumpur, Wilayah Persekutuan Kuala Lumpur